I'm starting to wonder if OPEC is doing this to crash the economies of countries that depend on high oil prices

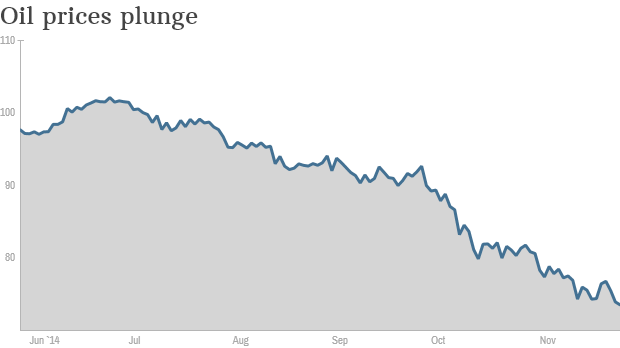

Oil prices came crashing down Thursday to trade below $70 per barrel after OPEC announced it was leaving oil production levels unchanged.

WTI crude trading in the U.S. fell by roughly 7% to just below $69 -- a level not seen since May 2010.

In Europe, Brent crude prices also fell by about 7% to trade just below $73.

Many had expected OPEC to agree on a cut to oil production in a bid to boost prices.

But the organization of major oil producing nations refused to budge after six hours of negotiations. Specifically, Saudia Arabia, which has the most clout among the OPEC members, wanted production levels to stay put.

This lack of action is bad news for certain oil-producing countries like Russia, Nigeria and Venezuela, which depend on prices of at least $90 a barrel to meet their economic targets.

Lower oil prices could also halt the U.S. shale oil boom, which depends on higher prices.

Meanwhile, some OPEC members including Saudi Arabia, Kuwait, Qatar and the United Arab Emirates can afford to be less concerned about falling prices because they have built up a deep financial cushion of $2.5 trillion dollars in combined savings.

"The Gulf authorities may see a period of lower oil prices as working in their favor over the longer-term, particularly if it squeezes the shale industry in the U.S.," said Jason Tuvey, a Middle East economist at Capital Economics.

Shares in major oil companies, including BP (BP) and Royal Dutch Shell (RDSB), were dropping on the London stock exchange after the OPEC decision was released.

Stock markets in the U.S. were closed for the Thanksgiving holiday.

and that would be a yes

Reuters) - Saudi Arabia's oil minister told fellow OPEC members they must combat the U.S. shale oil boom, arguing against cutting crude output in order to depress prices and undermine the profitability of North American producers.

Ali al-Naimi won the argument at Thursday's meeting, against the wishes of ministers from OPEC's poorer members such asVenezuela, Iran and Algeria which had wanted to cut production to reverse a rapid fall in oil prices.

They were not prepared to offer big cuts themselves, and, choosing not to clash with the Saudis and their rich Gulf allies, ultimately yielded to Naimi's pressure.

"Naimi spoke about market share rivalry with the United States. And those who wanted a cut understood that there was no option to achieve it because the Saudis want a market share battle," said a source who was briefed by a non-Gulf OPEC minister after Thursday's meeting.

Oil hit a fresh four-year low below $72 per barrel on Friday [O/R]. A boom in shale oil production and weaker growth in China and Europe have sent prices down by over a third since June.

"You think we were convinced? What else could we do?" said an OPEC delegate from a country that had argued for a cut.

Secretary General Abdullah al-Badri effectively confirmed OPEC was entering a battle for market share.

Asked on Thursday if the organization had a answer to rising U.S. production, he said: "We answered. We keep the same production. There is an answer here".

OPEC agreed to maintain -- a "rollover" in OPEC jargon -- its ceiling of 30 million barrels per day, at least 1 million above its own estimate of demand for its oil in the first half of next year.

NEW WORLD

Analysts said the decision not to cut output in the face of drastically falling prices was a strategic shift for OPEC.

"It is a brave new world. OPEC is clearly drawing a line in the sand at 30 million bpd. Time will tell who will be left standing," said Yasser Elguindi of Medley Global Advisors.

The OPEC delegate from one of the countries that wanted a cut, said: "OPEC has lost credibility," and added: "I don't know how practical it is to try to kick shale out of the market."

Several OPEC ministers who wanted a cut left the meeting room visibly frustrated and kept silent for several hours although when they spoke later they said they accepted the decision.

"We are together," said Venezuelan Foreign Minister Rafael Ramirez when asked whether there was a price war within OPEC.

"OPEC is always fighting with the United States because the United States has declared it is always against OPEC... Shale oil is a disaster as a method of production, the fracking. But also it is too expensive. And there we are going to see what will happen with production," he said.

A Gulf delegate said Naimi had reassured members that the oil price would recover as demand will ultimately pick up. But he insisted that if OPEC cut output it would lose market share.

"Reaching a final decision took a lot of time convincing the others," said another delegate.

Several analysts and oil executives have suggested it would take many months to have an impact on U.S. oil production.

Even some Gulf delegates said they were not convinced Naimi's gamble would work. One said: "If they are really after U.S. shale, how much would this rollover slow them (U.S. producers) down?"

http://www.reuters.com/article/2014/11/28/us-opec-meeting-shale-idUSKCN0JC1GK20141128

20 Feb ’12

Offline

OfflineI would not be surprised if this was in part done to combat alternative energy. Pricing on alt energy has been diving, and oil soaring, making alt energy more and more attractive. They could also be pushing up production to get their supplies out before the world largely switches to alt energy.

Most Users Ever Online: 698

Currently Online:

48 Guest(s)

Currently Browsing this Page:

1 Guest(s)

Top Posters:

easytapper: 2149

DangerDuke: 2030

groinkick: 1667

PorkChopsMmm: 1515

Gravel Road: 1455

Newest Members:

Forum Stats:

Groups: 1

Forums: 12

Topics: 11482

Posts: 58640

Member Stats:

Guest Posters: 2

Members: 19842

Moderators: 0

Admins: 1

Administrators: K

Log In

Log In Home

Home