Wonder when the retail side will start seeing lower prices

Carrie Mess, like most dairy farmers, is losing money every time the cows are milked on her farm near Watertown.

As farmers gear up for spring planting, those who sell crops on the commodities markets stand to lose buckets of money from low prices that are beyond their control.

Simply put, what many farmers are paid for milk, grain or livestock now isn't enough to cover their expenses. They're taking out loans and tapping savings to remain in business, going to work every day knowing that it's costing them money.

The Mess family farm milks about 100 cows and raises 300 acres of crops.

Even farmers born into the business are a little nervous about the downturn, according to Mess.

"We don't know when this will turn around," she said.

U.S. net farm income is expected to drop to $54.8 billion this year, the lowest since 2002 and less than half the record of $123.3 billion in 2012, according to the U.S. Department of Agriculture.

While the outlook for grain farmers has improved some in recent months, the global marketplace is still awash in corn and soybeans — much of it left over from a bountiful harvest last fall.

Meanwhile, U.S. farmers plan to sow 93.6 million acres of corn this year, exceeding all analyst estimates and boosting prospects for higher supplies that could further depress prices.

Growers hope that better-than-normal yields will help them at least break even.

"We are swimming in corn, soybeans ...all of these commodities, and the U.S. dollar is so strong that nobody (overseas) can afford them," said Ross Bishop, a beef cattle and crops farmer in Washington County.

A drought or a flood that wipes out thousands of acres of U.S. crops could reduce the harvest and boost prices. Likewise, poor weather in South America or another part of the world might help.

"It's sad because you have to hope for a disaster somewhere," Bishop said.

27 Aug ’14

Offline

OfflineAnd yet red bell peppers cost me $3 a piece here in Arlington. There's a huge push local for CSAs here, any farmers markets up in the Northeast? What I'm amazed at is that with oil most vendors are slow to lower their prices after their own costs are lower, cause their profit momentarily surges. Grocery stores don't have the same signs posted out front showing produce prices for ease of comparison so I'm wondering if they're slower to respond, if they ever do.

well, looks like subsidies are going up

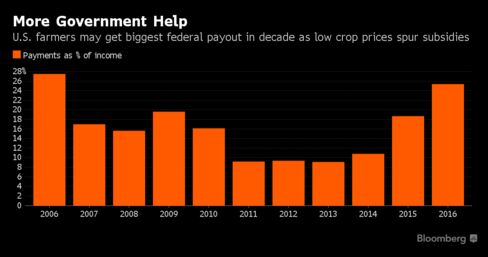

The agriculture slump is getting so bad in the U.S. that farmers are about to get more government aid than at any time in the past decade, signaling the rising public cost of crop surpluses and cheap food.

About $13.9 billion of net farm income this year will be federal payments, or about 25 percent of total profit estimated at $54.8 billion, according to estimates by the U.S. Department of Agriculture. That’s the biggest payout and highest ratio since 2006, as programs authorized by Congress two years ago cost more than originally forecast.

Farmers will earn less than half what they did just three years ago, before global surpluses sent commodity prices plunging. Corn and soybeans, the biggest U.S. crops, are so cheap that farmers are expecting to lose money on every acre they plant this season. That’s putting a bigger strain on government safety nets for agriculture.

“This is a sign of a weak farm economy that is much weaker than even a couple years ago,” said Patrick Westhoff, director of the Food & Agricultural Policy Research Institute at the University of Missouri in Columbia.

Most Users Ever Online: 698

Currently Online:

38 Guest(s)

Currently Browsing this Page:

1 Guest(s)

Top Posters:

easytapper: 2149

DangerDuke: 2030

groinkick: 1667

PorkChopsMmm: 1515

Gravel Road: 1455

Newest Members:

Forum Stats:

Groups: 1

Forums: 12

Topics: 11482

Posts: 58640

Member Stats:

Guest Posters: 2

Members: 19842

Moderators: 0

Admins: 1

Administrators: K

Log In

Log In Home

Home